Image from Pixabay. Gold is lots of things to lots of people. To some, it’s the ultimate store of value and a source of financial freedom. To others, it’s just a shiny rock with an inflated, emotionally-driven price. Gold’s most popularly used to hedge inflation risk; to preserve purchasing power from thieving bureaucrats and central..

Category: market commentary - page 2

Image by ErikaWittlieb from Pixabay I’m truly shocked to watch events unfold in the Chinese investment markets. Throughout the year, the Chinese Communist Party (CCP) progressively restricted freedoms of its citizens, plummeting share prices for some of the largest companies in the world. While this not-so-naked power struggle between economic and political factions is as..

Image by RoboAdvisor from Pixabay Environmental, social, and governance (ESG) investing is all the rage these days. Naturally, funds are launching to meet the growing investor demand. However, new company formation cannot keep pace with inflows. Yet, the investible universe is expanding nonetheless. Something funny‘s happening. Nearly every type of company is becoming ESG-compliant without..

Image by StockSnap from Pixabay As I sat down to write this month’s article, just one topic came to mind: inflation. Readers know that I just wrote on this theme. Yet, it remains topical and I have more to exploring to do. I’m specifically interested in why we’re seeing inflation now and does it even..

Image by kalhh from Pixabay I’ve got inflation on my mind these days. Who doesn’t? The U.S. 10-year treasury yield is up nearly 3-fold in the past year, stoked by fears of inflation. Commodities too are rocketing higher for similar reasons (in part). However, I’m not convinced these trends will hold. To me, the deck..

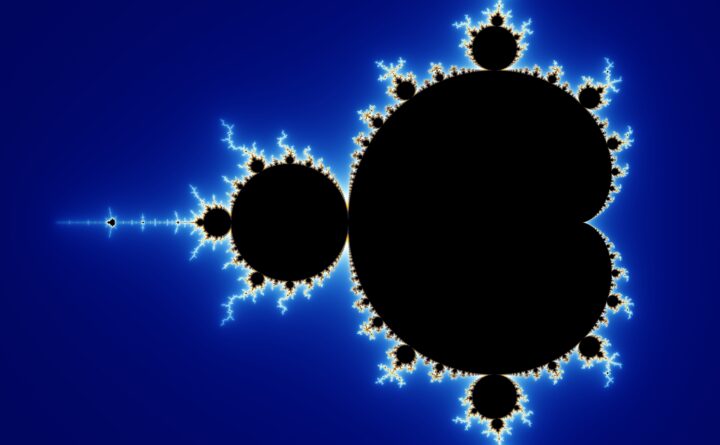

Created by Wolfgang Beyer with the program Ultra Fractal 3. – Own work, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=321973 I’m currently reading Benoit Mandelbrot’s brilliant book The Misbehavior of Markets: A Fractal View of Financial Turbulence (TMM). In it, Mandelbrot makes a case for discarding the bell curve when modeling financial markets, the bedrock of modern financial..

Image by Luiz Jorge de Miranda Neto- Luiz Jorge Artista from Pixabay 2021 sure picked up from where 2020 left off. As if things couldn’t get any crazier than a global pandemic, a group of retail investors seemingly organized an epic short squeeze in GameStop Corp’s stock (GME) so violent that it bankrupted a $12.5..

Image source Universal Studios via Wikipedia I often feel like the financial markets are crumbling around me. It’s not their price levels that trouble me, but their health. The capital markets are a tremendous boon to humanity. However, intrusive central bank and government policies seem to increasingly strangle the golden geese of capitalism and free..

Image by Leonhard Niederwimmer from Pixabay “It’s up to you New York, New York” — Frank Sinatra, Theme From New York, New York The magnitude of change that the coronavirus (COVID) ushered in is truly astonishing. It’s upheaved industries, professions, and the very fabric of many lives. Among the apparent victims is New York City..

Image by Omni Matryx from Pixabay These are truly fascinating times to be an investor. Markets seem to be going through a generational phase shift, and not necessarily for the best. I see a culture that is leading itself away from prosperity and towards the abyss, and I’m helpless to stop it. My emotions run..