Image by Mira Cosic from Pixabay No matter how you slice it, markets are human. This even applies to the “algos” as it’s we who write their mechanistic marching orders. Thus, understanding human behavior can be helpful in assessing and anticipating market moves. There’s no choice in the fact that we all need a philosophy..

Category: market commentary - page 3

Image by 272447 from Pixabay 2020 is certainly not shaping up to be the year I had hoped for. Like many, I was optimistic at the start. I underwent some major surgery late last year and 2020 was going to be “my year.” Boy did those plans derail quickly. In the blink of an eye,..

Image by Free-Photos from Pixabay Passive investing has eaten active management’s lunch for decades. Its market share has grown steadily, capturing disproportionate amounts of inflows and allocation changes. Backed by scores of academic research, passive investing is pitched as a way to earn market returns with drastically lower fees. Why pay up for active managers..

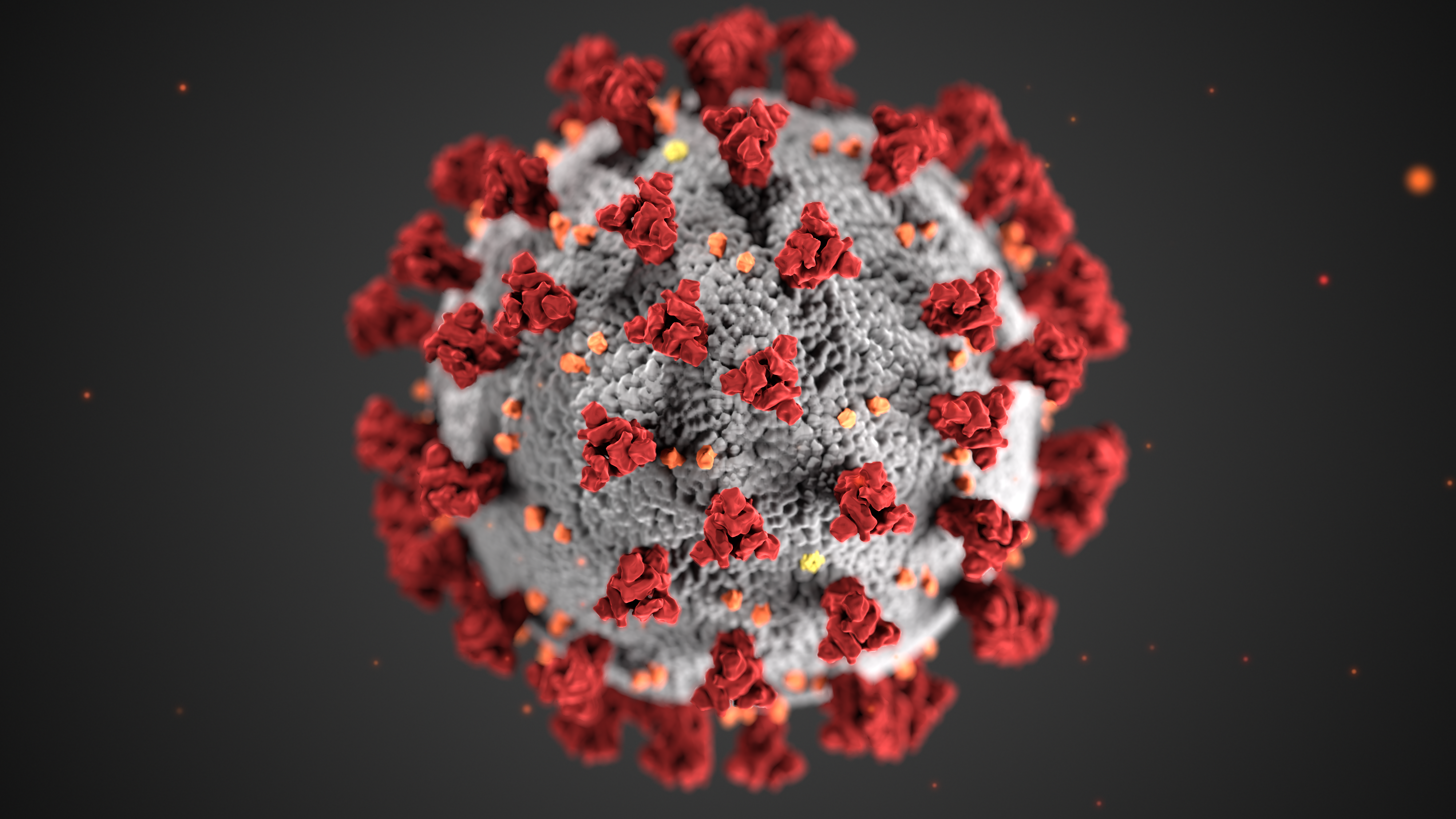

Image by the Centers for Disease Control and Prevention These are truly remarkable times in the investment markets. The speed, intensity, and ubiquity of this selloff brings just one word to mind: violence. It would be remarkable if it wasn’t so destructive. Sadly, the reactions from our politicians and the public were predictable. The Federal..

Image by Steve Bidmead from Pixabay When it comes to investing it’s never different this time; nor, however, is it ever the same. This difficult-to-navigate paradox creates a scarcity of longevity. Today’s persistently low yield environment has upped the ante and put many marquis names out of business. To be fair, alpha’s been elusive of..

Image by Nina Garman from Pixabay Have you heard? There’s trouble in the repo markets. Even casual investment market participants probably know that something’s amiss. While only a handful of investors participate in repo, this obscure corner of the investment markets rests at the epicenter of the financial system—hence all the attention. The turmoil caught..

Image by OpenClipart-Vectors from Pixabay I always find this time of year to be self-reflective. Year-end provides a natural point for critiquing past performance and fitting it into a broader investing context. These holidays in particular have a way of foisting this perspective upon me, and with deep meaning. As a parent of two young..

Image by Annalise Batista from Pixabay I previously postulated that negative interest rates are destructive (though profitable) and that they negate human life on a profoundly fundamental level. If they’re so bad, then how and why do they exist? Well, clearly not everyone sees it my way. My proclamations must be hyperbole, right? Not so..

“Remember that Time is Money.” Benjamin Franklin, Advice to a Young Tradesman It’s unfortunate that such genius identifications as the above have long been forgotten by the economic community. First penned in 1748, Benjamin Franklin makes the connection between human effort—or rather the application of human effort towards productive work—and the effect/product, i.e. wealth. We..

Image by rawpixel from Pixabay There’s an ongoing debate about whether or not the U.S. is approaching a recession. As an investor, this question is of utmost importance. It is precisely at these times when fortunes can be made and lost. There’s no shortage of pundits with strong opinions in both the affirmative and negative..