Image by Jose Antonio Alba from Pixabay So far, my 2023 investing looks just like 2022: lots of waiting. I’m not waiting for a recession to pass or for GDP to improve. I’m not waiting for a certain employment report or for corporate earnings to change. I’m not waiting for the Consumer Price Index (CPI)..

Category: volatility

Image by QuakerGirl22 from Pixabay Catching inflection points is the holy grail of trading. It’s what makes investing lore. From shorting the 2005 housing boom or skyrocketing technology stocks in 2000, to classic value investing, taking contrarian positions can create large profits and legendary reputations. While seductive, it’s a difficult way to trade over the..

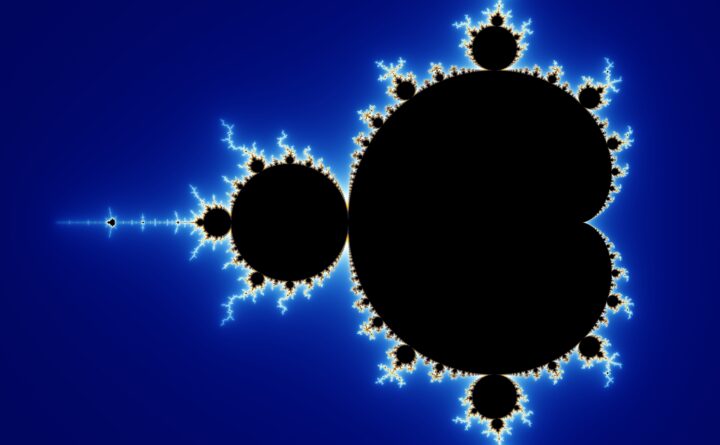

Created by Wolfgang Beyer with the program Ultra Fractal 3. – Own work, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=321973 I’m currently reading Benoit Mandelbrot’s brilliant book The Misbehavior of Markets: A Fractal View of Financial Turbulence (TMM). In it, Mandelbrot makes a case for discarding the bell curve when modeling financial markets, the bedrock of modern financial..

Image by Luiz Jorge de Miranda Neto- Luiz Jorge Artista from Pixabay 2021 sure picked up from where 2020 left off. As if things couldn’t get any crazier than a global pandemic, a group of retail investors seemingly organized an epic short squeeze in GameStop Corp’s stock (GME) so violent that it bankrupted a $12.5..

Image by David Mark from Pixabay The volatility in the investment markets over the past few months has been truly astonishing. Prices are violently fluctuating and the range of traditional volatility indicators like the VIX have exploded. Just look at the daily moves of the popular U.S. stock market indices for example. While it’s generally..

Image source: pixabay For this post, I’d like to offer a few “Disintegrated Thoughts” on some things I’ve been thinking about in the investment markets. These include: The ECB and volatility deleveraging Business building and ignoring valuations Sticking up for “speculation” Notes from the judo mat A spontaneously “live” ECB meeting and volatility deleveraging..

Image by Peter Selbach sourced from pixabay The following is Part 2 in a two part series. Part 1 of this series discussed my view of what volatility is and how it impacts investing. Here in Part 2, I present my read of the current volatility landscape and examine what it might mean for..

Image by Kira Hoffmann on pixabay The following is Part 1 in a two part series. If there were a Word of the Year award in finance it most certainly would go to volatility. It seems like nearly every article you read makes some reference to it. Is volatility gone for good or is..