Image by Free-Photos from Pixabay

Passive investing has eaten active management’s lunch for decades. Its market share has grown steadily, capturing disproportionate amounts of inflows and allocation changes. Backed by scores of academic research, passive investing is pitched as a way to earn market returns with drastically lower fees. Why pay up for active managers if they can’t consistently beat the S&P 500? However, this secular phenomenon might have created an “easy game” from which the astute active manager can (finally) profit. Fallout from the coronavirus (COVID-19) response could give us a preview.

Easy Games

In many ways, professional investing is a unique industry. Manager performance is not only judged against peers with whom they directly compete, but with whom they directly transact. In fact, these interactions are the source of profit and loss. You just don’t see this in many other industries. True, Coke and Pepsi are fierce competitors, but their profits come from third parties (i.e. customers), not each other. Coke doesn’t buy or sell anything from or to Pepsi, and vice versa.

This dynamic—whereby profits come from other participants—likens it to poker. The analogy is quite useful sometimes. Other times, however, if can be harmful. Michael Mauboussin’s “easy game” analogy is a case of the former.

The value proposition of investment funds is providing superior returns. Superior returns to what? Well, other investment options. Said simply, gains are made by buying low and selling high. Thus, there must be another investor on each leg of the trade. Here’s where investing resembles a game of poker since generating relative (excess) returns are zero-sum. According to Mauboussin:

“Active managers must believe in differential skill to justify their existence. Recall the poker metaphor. You want to join the game only if you are more skilled than some of the other players and hence can expect to take their money. In markets as in poker, excess gains and losses net to zero. For you to win, someone has to lose on the other side of the trade.”

Michael J. Mauboussin, Dan Callahan, CFA, and Darius Majd, Looking for Easy Games: How Passive Investing Shapes Active Management

To win the most money in poker, it helps to be the best player at the table. Don’t be the pasty. According to Mauboussin, studies show that individual investors tend to lose to institutions. The latter are the card sharks feasting upon the retail patsies succumbing to a laundry list of behavioral biases. It’s an easy game for the professional to win.

One Door Shuts, Another One Opens

The proliferation of passive investing turned the investment management industry on its head. Investors (both retail and institutional) fired their expensive active managers (or themselves) in favor of cheaper passive investment vehicles. Thus, there are simply fewer traders now. As the number of participants shrink, so too does the pool of patsies. As a result, there’s less “alpha” available.

This creates an interesting dynamic. The investing skill level is significantly up. It’s no longer an “easy game”, at least compared to its prior form. But like all industries undergoing disruption, when one door shuts, another one opens.

What’s So Easy About Passive

While the competitive landscape of investing drastically shifted, the fundamentals have not. It’s still about buying low and selling high. However, the motives of buyers and sellers have changed. Ace still trumps jack irrespective of the players’ strategies. Perhaps a few adaptations can make active management an easy game again.

Passive investing vehicles are rigidly algorithmic, transparent, and simple. These attributes make them an easy game candidate. No matter how complex the strategy, each investment action reduces to: Did money come in? If so, then buy according to the published rule. Did money go out? If so, then sell according to the published rule.

Thus, you know exactly how each passive investment vehicle will transact in the presence of a capital flow—what it will buy and what it will sell given a set of conditions. There is zero mystery, which is actually part of their allure. This lack of discretion creates an opportunity to front-run passive investments if you can properly forecast their flows. Thus, this once touted advantage could become their greatest weakness.

The Demographic Shift

From what I can tell, no one has analyzed the market structures of passive investing more than Mike Green, a partner and the Chief Strategist at Logica Capital Advisers. Fortunately for us, Green has shared his findings in a number of public interviews (most notably here, here, and here).

Green believes that the regulatory framework incentivizes passive investing in retirement accounts. Thus, these vehicles benefited from decades of inflows, which in turn helped buoy prices. Remember: Cash in, then buy. Thus, the mere act of saving for retirement helped inflate investment values.

“The idea that passive players are passive players is just completely absurd. What they are is active players that have super, super simple rules and a massive regulatory advantage. … Passive is assuming that they’re not having any influence on that next price but they have to be because they are transacting.”

Mike Green, The Acquirers Podcast (Ep. 55)

However, this trend may now be reversing. Baby Boomers are the first generation to have defined contribution retirement accounts (401(k)s, IRAs, etc.). They are now at the age that legally mandates distributions—i.e. they have to sell. Thus, we are at the beginning of a demographic shift from buying passive investments to selling them! Remember the algorithm: Money out, then sell.

“The rule is constructed … that once you turn 70.5, you have to start taking distributions. The baby boomers are the first generation that had 401(k)s and IRAs as their primary mode of retirement vehicles. The generations that came before them had defined benefit plans. … The year they just turned 70.5 is 2017, the year after that is actually when they had to first start selling. That, in my estimation, is what happened in 2018, is that we saw large supply that occurred in the fourth quarter of 2018.”

Mike Green, The Acquirers Podcast (Ep. 55)

Faulty Foundations

However, it’s not just demographics that may plague passive investments. They are built upon several questionable assumptions. The most glaring one is that passive investments don’t impact market prices. By definition, every market participant does. Perhaps when passive investing was a negligible part of the markets this assumption held. However, the more AUM they garner, the more problematic this assumption.

Another theoretical fault is that investing is a closed system, like poker. This is plainly false. Capital routinely enters and leaves investment markets as individual cash needs wax and wane. Nor do passive investments approximate the entire universe of investment options, as required by theory. For example, an S&P 500 ETF only invests in the 500 stocks comprising the index—hardly a complete set of market assets.

Ergodicity is another dubious assumption presumed by the foundational theories of passive investing. An ergodic system is one where the future distribution of outcomes is known in advance since it’s the same as the historical one. Investing is anything but; past performance does not guaranty future results. We simply can’t know what the future will bring. This is another important way in which investing differs from poker and other games of chance.

A COVID-19 Catalyst

Green specifically identified demographics as a secular market structure trend supporting passive investing’s success. However, the recently imposed economic lockdowns related to the COVID-19 outbreak could give us a preview of his thesis.

As noted, passive investment strategies play central roles in defined contribution retirement plans. Thus, they are inextricably linked to employment. Workers can only participate if they have jobs. Retirements, layoffs, and furloughs may not only halt contributions, but could even catalyze withdrawals.

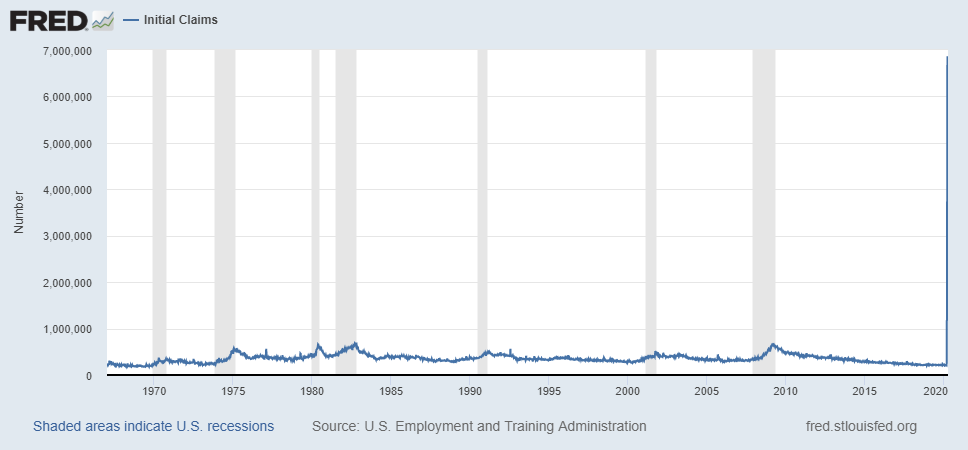

Recently, new unemployment claims spiked to staggering levels due to COVID-19, the likes of which have never been seen. Over the past 3 weeks, initial jobless claims totaled nearly 19 million! More could come if the quarantines continue. Thus, capital inflows to retirement accounts may soon dry up and could even reverse. The recently passed CARES Act could exacerbate the latter since it relaxed penalties for early retirement account withdrawals. That said, layoffs have yet to hit those most with retirement accounts.

You know what continues to be really weird: deposits to the treasury for income and employment taxes withheld are not showing the decline in employment at all. That means essentially no cuts in large payrolls (i’ll elaborate in further posts) pic.twitter.com/Hdg9SITp2w

— New River Investments Inc. (@NewRiverInvest) April 10, 2020

Playing Easy Games

Capital steadily flowed into passive investment vehicles for decades. This created a self-reflexive loop, whereby their inflows helped bid up their very own prices, boosting their relative performance (vis-à-vis active managers), which in turn attracted more assets, etc., etc., etc. Strong academic backing, fierce lobbying efforts, and low fee structures have universally embedded them in investment portfolios of institutions and individuals alike.

Green’s passive investment thesis is as unique as it is interesting. He’s one of the few outspoken critics of the passive investment industry and the faulty assumptions at its foundation (markets are complete, ergodic, and that passive investments do not influence market prices, to name a few). If he’s right, the secular capital flow-tailwinds into passive investment vehicles may soon reverse. The recent spike in unemployment may even provide a preview.

We already know how passive investment vehicles will transact in the presence of capital flows. If these become realistically forecastable, say due to legally mandated retirement distributions or a cyclical surge in unemployment, then so too may the transactional behaviors of passive investments become. For the astute active manager, this kind of setup may have the makings of an easy game.

If you enjoyed this article please consider sharing it with others.

Seth,

With regulatory headwinds and a persistently higher fee structure, does active investing have to be a much smaller portion of the market in order to start generating consistent alpha vs passive strategies? It seems as though the table is slanted against active management, so the “easy game” may require more passive players (and possibly less active players).

That’s an interesting question. No reason why active managers couldn’t follow suit and lower fees. That said, I think active and passive investors simply play different games. Valuation is important to the former and capital flows to the latter.

Thanks for the post. Have been thinking about this a lot.

My other question is how will incredibly low or negative rates play into this? They should encourage Boomer investors to keep money in stocks no?

Yet etf.com is showing steady outflows from the SP500 and into HYG and other fixed assets…. thoughts?

Thanks for reading and for your comment. It’s definitely possible that low interest rates will keep Boomers more invested in stocks and, in particular, those with high(er) dividend yields (I’ve seen this anecdotally). However, as Mike Green points out, younger generations tend to hold more passive assets. It’s the Boomers who disproportionately own active managers. Thus, the liquidation of retirement accounts could actually exacerbate the pressure on active flows. Where those flows end up is anyone’s guess, but we’ve certainly seen capital chase yield to the most obscure corners of the investment markets – from private credit to systematic vol selling.

Believe Mohammed El Elarian makes your case as well. He sees a shift to selective stock picking and regards indexing as a passe strategy. The virus is the catalyst. Here is his 7 minute interview and well worth the time:

Bloomberg TV (@BloombergTV) tweeted at 6:55 AM on Thu, Apr 23, 2020:

There’s “massive cognitive failure” in markets to process the extent of the damage to the global economy, @bopinion’s @elerianm tells @FerroTV https://t.co/ObaBUdnUCr https://t.co/a9Klo3Gebw

(https://twitter.com/BloombergTV/status/1253321591712182275?s=03)

Thanks for your comment and sharing this. Green’s argument is actually quite different. El Elarian is making the case for fundamental analysis based on an uneven economic landscape. Green’s thesis – and my expansion – is based on the flows of money into and out of passive investment vehicles, specifically; ie the fundamentals of passive investing. A big cohort of passive investment buyers (retirement accounts) may no longer be buyers to the same extent.

Excellent perspective. Nicely done Seth!

IRS forces holders of IRAs to make minimum required withdrawals at certain ages. IRA does not force those people to spend the resulting cash. Sure, some of the cash goes to pay income taxes, but what’s left may stay in the market via reinvestment. This may or may not be a negligible consideration is thinking that mandatory withdrawals are a significant negative for stocks.

That’s a very good point! However, even if it stays in the market, it may not stay in the same passive vehicles, or even the same markets (like stocks). To be sure, there are lots of variables. I have no clue how it plays out, but this does seem like a risk.

Thanks a lot Justin! I’m glad you enjoyed it. However, it’s easy to stand on the shoulders of giants.