Image by Carlos Lincoln from Pixabay Central banks endlessly fascinate me. The more I research them the more contradictions I find, particularly since their missions and impacts changed over time. Take the Federal Reserve (Fed), for example. It was originally created to countercyclically balance volatile market forces in times of stress. However, the evolution of..

Author: Seth Levine - page 2

Image by Dinh Khoi Nguyen from Pixabay Inflation is one of the most important, debated, and controversial investment themes today. It’s impacting every asset class from fixed income to commodities to equities. Yet, inflation’s widely misunderstood. While well-known among layman and expert alike, inflation’s definition changed over time. However, not everyone has noticed. As inflation’s..

Image by Jose Antonio Alba from Pixabay So far, my 2023 investing looks just like 2022: lots of waiting. I’m not waiting for a recession to pass or for GDP to improve. I’m not waiting for a certain employment report or for corporate earnings to change. I’m not waiting for the Consumer Price Index (CPI)..

Image by congerdesign from Pixabay I read a fair amount these days. I do it strictly for pleasure which frees me to take my time and explore a wide range of topics. While not everything I read is about investing, I find many to have relatable themes. Below is a catalog of books and papers..

Image by Tim C. Gundert from Pixabay Many types of currencies have been used throughout history. Sometimes commodities defined them. Other times, private bank notes circulated as mediums of exchange. Today, fiat currencies reign supreme while some eye cryptocurrencies as the future. Like so many aspects of money, currencies are hotly debated. This results from..

Image by 14995841 from Pixabay Note from the author: I use the terms stability and instability throughout this article. However, resiliency and fragility, respectively, more accurately describe the phenomena that I’m describing. Centralization creates fragility and decentralization creates resiliency. Please note this as you read the article below which I left in its original form…

Image by Penny from Pixabay Everyone loves to talk about money. While commonplace, money actually means different things to different people. Its many and conflicting definitions lead to vastly different economic conclusions and tend to confirm one’s preferred viewpoint. As a result, money’s lost all utility as an objective investment tool. However, redefining it in..

Image by Manuel from Pixabay Speculation’s a dirty word for investors. It conjures images of reckless, degenerate gamblers, thoughtlessly buying and selling securities on whims and tips, hoping to strike it big; and fast. Contrast this to investing. Investing is perceived as thoughtful, careful, patient, and productive. Despite the resemblance to speculation, investors play mental..

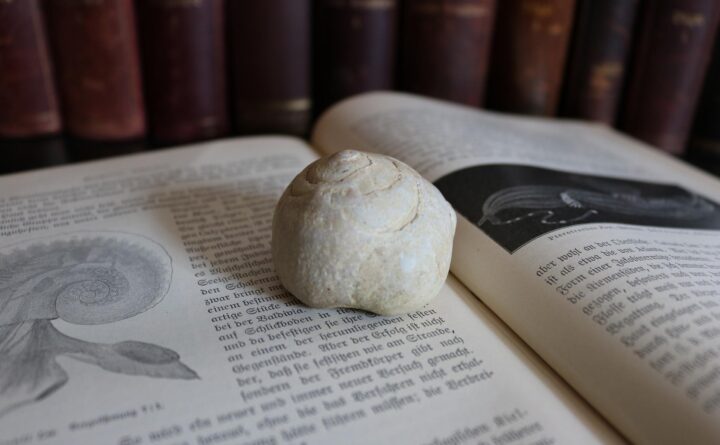

Image by Christian Storb from Pixabay I can’t shake money from my mind. It features prominently in this age of pervasive central banking, Wall Street bailouts, investment market obsessions, and cryptocurrency culture wars. Many seem to have prospered by betting big on money-related investment themes from speculating on Bitcoin, to buying profitless technology stocks, or..

Image by bridgesward from Pixabay Everyone loves to dunk on the Federal Reserve (Fed). To many, the setters of U.S. monetary policy never get it right. Its stable of Ph.D. economists are always too late, or too slow, or too early, or too fast. Shockingly, many have built prominent careers in peddling this viewpoint. Yet,..