Image by Hermann on Pixabay I read a fair amount these days. I do it strictly for pleasure which frees me to take my time and explore a wide range of topics. While not everything I read is about investing, I find many to have relatable themes. Below is a catalog of books and papers..

Year: 2021

Image from Pixabay. Gold is lots of things to lots of people. To some, it’s the ultimate store of value and a source of financial freedom. To others, it’s just a shiny rock with an inflated, emotionally-driven price. Gold’s most popularly used to hedge inflation risk; to preserve purchasing power from thieving bureaucrats and central..

Image by ErikaWittlieb from Pixabay I’m truly shocked to watch events unfold in the Chinese investment markets. Throughout the year, the Chinese Communist Party (CCP) progressively restricted freedoms of its citizens, plummeting share prices for some of the largest companies in the world. While this not-so-naked power struggle between economic and political factions is as..

Image by Daniel Kirsch from Pixabay We live in the golden age of content. There are so many high-quality investor interviews these days. To be sure, technological advancements facilitated this growth. However, none would be possible without people’s generosity. Interviewees graciously share their time and hard-earned insights. Their stories and lessons have been invaluable for..

Image by RoboAdvisor from Pixabay Environmental, social, and governance (ESG) investing is all the rage these days. Naturally, funds are launching to meet the growing investor demand. However, new company formation cannot keep pace with inflows. Yet, the investible universe is expanding nonetheless. Something funny‘s happening. Nearly every type of company is becoming ESG-compliant without..

Image by Arek Socha from Pixabay The hype never ends when it comes to cryptocurrencies. These days, the Metaverse and non-fungible tokens (NFTs) have the spotlight. Like their predecessors (blockchains like Bitcoin and Ethereum) they carry intimidating labels and lofty promises brandished by their supporters. After all, it doesn’t get more “meta” than the Metaverse…

Image by StockSnap from Pixabay As I sat down to write this month’s article, just one topic came to mind: inflation. Readers know that I just wrote on this theme. Yet, it remains topical and I have more to exploring to do. I’m specifically interested in why we’re seeing inflation now and does it even..

Image by kalhh from Pixabay I’ve got inflation on my mind these days. Who doesn’t? The U.S. 10-year treasury yield is up nearly 3-fold in the past year, stoked by fears of inflation. Commodities too are rocketing higher for similar reasons (in part). However, I’m not convinced these trends will hold. To me, the deck..

Image by WorldSpectrum from Pixabay “Bitcoin fixes this.” I cringe every time I see this popular meme. I find it worse than nails on a chalkboard. Bitcoin and other cryptocurrency (crypto) supporters seem to wheel this tired trope out for every problem they see, particularly at economic ones. To their credit, they genuinely want to..

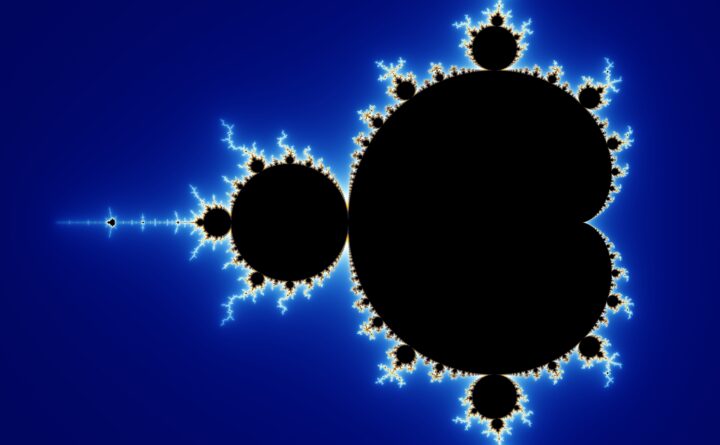

Created by Wolfgang Beyer with the program Ultra Fractal 3. – Own work, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=321973 I’m currently reading Benoit Mandelbrot’s brilliant book The Misbehavior of Markets: A Fractal View of Financial Turbulence (TMM). In it, Mandelbrot makes a case for discarding the bell curve when modeling financial markets, the bedrock of modern financial..