Image by Berenice Calderón from Pixabay

The failure of Silicon Valley Bank (SVB) has brought questions of systemic risk to the forefront. SVB was the third regional bank to fail this month (along with Signature Bank and Silvergate Bank, collectively referred to as the “S Banks”). These coincided with the Swiss government-brokered acquisition of Credit Suisse (CS) by UBS Financial Services. Coincidence? I think not. Rather, it highlights the high-risk environment created by central banks’ protracted low interest policies.

Appearances can be misleading

On the surface, all these events can be (and have been) categorized as failures of asset-liability management (ALM) catalyzed by idiosyncrasies. The S Banks failed due to ordinary bank runs related to their unique deposit characteristics—namely large, uninsured crypto and venture capital-related clients. They had questionable customer concentrations and risk management policies that led to deposit flight. To be sure, no bank can survive a run. CS … well, CS is just CS. It never recovered from the Great Financial Crisis (GFC) and has arguably been on life support ever since.

Yet, these situations share a similar trait. No S Banks could liquify enough cash from their investment portfolios to meet their liability demands (i.e. deposit withdrawals). Why not? Did they take outsized investment risks? I argue no, thus highlighting the systemic nature of their risks. While each bank failed due to ALM, decades of low interest rates made ALM a systemic problem.

Naughty by nature

The systemic nature of the S Banks’ problems becomes evident in light of two critical facts: 1) banking is a (leveraged) carry trade, and; 2) balance sheets balance. Banks invest and loan borrowed funds from depositors and capital markets. Thus, ALM is critical to a bank’s success. They must balance their projected cash outflows with incoming cash flows or risk failure. Furthermore, bank assets match their liabilities (and equity) as the latter funds the former. In theory, bank liabilities are fully covered.

Why, then, did SVB fail instead of meet withdrawal demands? Couldn’t it sell liquid securities to raise cash? Unfortunately, it could not; otherwise, it would have, and we might not even be discussing the regional bank.

Prior to failing, SVB sought to raise ~$2.0 billion of equity (via common and preferred, including over-allotments), a similar amount that it lost liquidating securities ($1.8 billion after tax). This suggests that SVB might have survived absent these losses and is the crux of my systemic thesis.

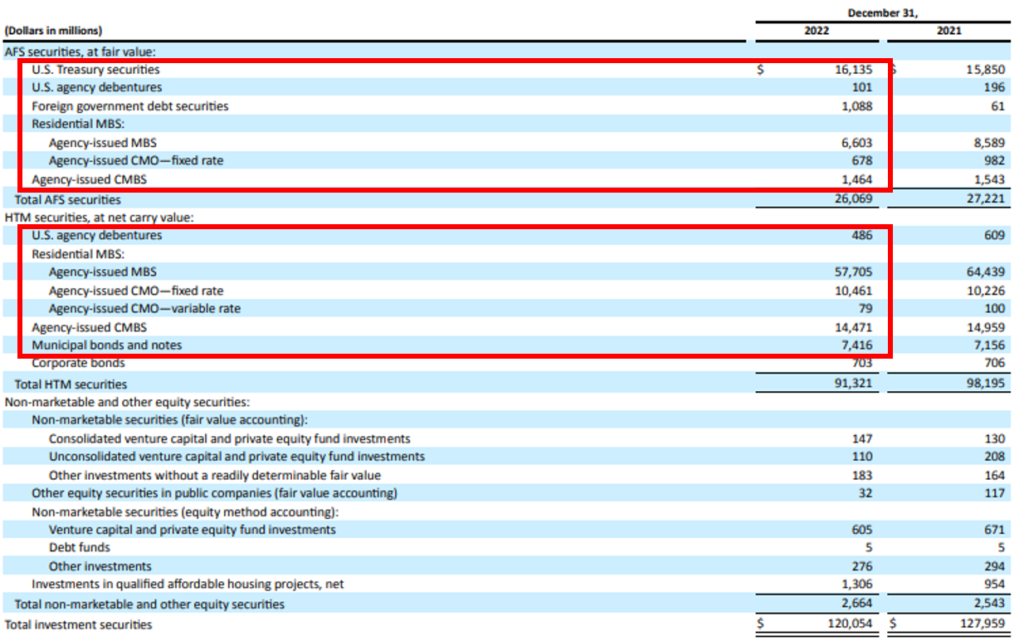

Below is a snapshot of SVB’s investment portfolio. Note, it’s of extremely high quality. About 97% of its portfolio was invested in government bonds (including agencies and municipalities). Yet, SVB could not monetize these at (or near) par. The bank sold approximately $21 billion at a 9-point discount (it incurred a $1.8 billion after tax loss).

About 97% of SVB’s portfolio was invested in government bonds (including agencies and municipalities). Source: SVB Financial Group 10k

Why did SVB realize investment losses in such a high-quality investment portfolio? It did not suffer idiosyncratic credit losses. Most holdings were considered (virtually) riskless. In fact, few doubt that SVB would have been paid back in full for them at maturity. Unfortunately, SVB could not wait. It needed liquidity now. SVB incurred large duration losses (i.e. strictly due to changes in interest rates). These losses are systemic. They solely relate to the Federal Reserve’s (Fed) protracted period of low interest rates and its abrupt 450 bps hiking cycle. Every fixed income investor is afflicted. The Fed created this same problem throughout the entire financial system.

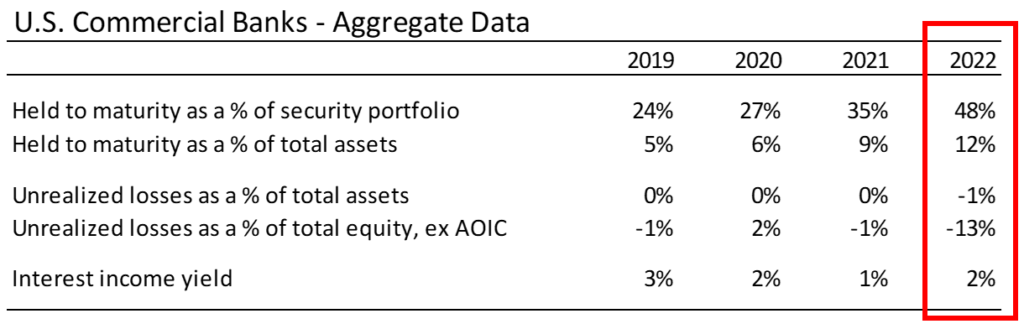

SVB is not the only bank to invest in government debt or mortgage-related securities. Thus, they are not the only bank (or financial services company) with an underwater bond portfolio, high-quality or otherwise. However, most losses remain safely sheltered as unrealized. They become problematic only upon realization. Both points are equally important. As shown below, the U.S. commercial banking sector (as a whole) has large, dormant exposures to potential losses in held to maturity securities and other unrealized losses. Its capital base is fragile.

The commercial banking sector has large, dormant exposures to potential losses in held to maturity securities and other unrealized losses. Source: S&P Capital IQ

Lower rates, not a Fed liquidity facility is needed

In response, the Fed created a new Bank Term Funding Program (BTFP). The BTFP will offer collateralized loans up to 1 year to any U.S. federally insured depository institution. Eligible collateral will mirror the Fed’s open market operations (i.e. primarily U.S. treasuries, agency debt, and mortgage backed securities). The Department of the Treasury will backstop the BTFP up to $25 billion.

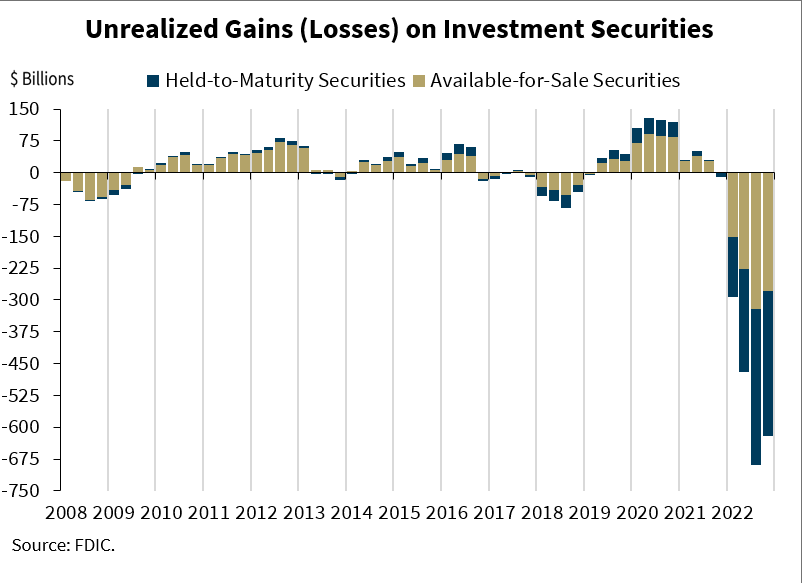

According to the FDIC, the banking industry carried ~$620 billion of unrealized losses in available for sale or held to maturity securities at year end 2022. Thus, the Fed’s facility is not large enough to cover all (potential) losses.

To be sure, the Fed need not cover all losses; only those related to deposit flight. However, given the role that confidence plays with depositors, this facility seems under-sized. The only systemic solution is to lower rates and reverse the process that created these conditions. While Treasury Secretary Janet Yellen told lawmakers that “Certainly, we would be prepared to take additional actions if warranted”, nationalizing bank deposits (via insurance or otherwise) seems like a tall order. It would be far easier, simpler, and less controversial to deflate these unrealized losses with lower interest rates. Thus, the Fed seems likely to end its hiking cycle soon; it might even cut rates.

Higher risk, not certain doom, but action warranted

As noted, the S Banks and CS failed for specific reasons. Others banks might avoid their fates with diversified deposit bases, interest rate hedges, better risk management, etc. That, however, is not the point. What matters, in my opinion, is that investment risk is currently high.

Consistent investing does not require catching market tops and bottoms. It’s about managing risk. Successful investors increase exposures when conditions seem favorable and reduce them risk appears high. Right now, I see the potential for systemic trouble. Thus, I’ve turned cautious with my investing. To be sure, these risks may never materialize and I might miss a market run. So be it; that’s part of investing. It beats the alternative (i.e. losing money).

Unsound conditions heightens risk

Conditions seem ripe for a systemic crisis created by the Fed. Decades of low interest rates and Quantitative Easing created large duration risks across all fixed income portfolios. Abrupt rate hikes woke these risks from a dormant state. Underwater bond portfolios losses greatly increased the probability for large duration losses to realize, thus creating fragile conditions across the entire system.

To be sure, disaster need not happen. However, small catalysts can potentially create large effects due to the leverage inherent in the financial system. Thus, I’m de-risking my own investments. Crypto and VC related angst triggered the S Bank failures. Institutional clients fled CS. In all cases, the headline causes were just the matches tossed into the central bank-created tinderbox.

If you enjoyed this article please consider sharing it with others.

As I ponder the pieces of this situation, especially now, 2 weeks later when there has been such a HUGE effort to explain it as a single bank issue, I cannot help but wonder what will be the next shoe to drop. Just looking at the timeline of the GFC, the first pieces started falling apart 18 months before Lehman went bust and AIG got saved. But the pace of problems did increase as we approached the ultimate climax. It beggars belief that no other banks will have an issue, or perhaps, no other financial entities, as the Fed clearly only has bandwidth to follow a single group of highly leveraged financial entities, and not that well at that. Look at what happened in the UK with pension funds, and it is easy to imagine insurance companies stumbling if the Fed keeps hiking rates further. Certainly, there is no inkling, yet, that they are going to listen to you Seth!

Thanks for you comments Andy. I’m with you that this seems like the tip of the iceberg. We’ll only know in time though, which is why I’ve remained cautious.

I believe the BTFD can be levered up to back stop more than the $25B allocated to the program. As I see it, the program basically gives banks up to two years to fix their ALM mismatch (assets can be pledged for a one year term up to a year from now). As such, it should solve the liquidity problem of bank runs assuming credit losses remain subdued.

But the greater point that much of the financial system is underwater on their security portfolios remains true and is a vulnerability. Life insurer unrealized losses are massive, but the business is designed to make liabilities sticky. The passing of time, or lower rates, will solve the problem for them, and would have solved SVBs problems as well, but banks don’t necessarily have that same luxury…as we saw at SVB. Ironically what was supposed to fix SVB (raising equity to fill the AFS unrealized loss hole) was what brought greater attention to the issue and began the bank run.

As always Seth, enjoy your work.

Thanks Jeff! You might be right on the BTFD (I don’t know) and are definitely right on life insurers. The central banks created the system-wide duration risk potential, but that potential requires the liabilities to shorten to realize. Just harder to see with insurers, and is sadly too easy with banks.

Spot on: We are experiencing a systemic crisis caused by years of Fed suppression of interest rates.

Thanks Jim! It’s kind of funny when you think about it: the Fed is doing exactly what it was designed to to, try to prevent carry trades (i.e. banks) from unwinding. Of course, there’s no free lunch so the leverage and risk grows bigger with each intervention.