-

-

The Real Benefits Of Private Credit

Image by Oleksandr Pidvalnyi from Pixabay I’ve been quite critical of private investments. They’ve grown tremendously over the past decade. Drawn to their seemingly high returns and low volatilities, investors have poured billions into them, reallocating funds from traditional public stocks and bonds. While the Federal Reserve’s (Fed) aggressive policy hikes slowed inflows for some…

-

There Was An Old Bank Who Swallowed A Rule

Image by Stable Cascade To this day, banking confuses many. The industry’s myriad of jargon and regulations can understandably perplex casual investors; however, they also confound experts—even those specializing in the discipline. Yet, banking is really quite simple. Banks borrow to lend. Their complexity is purely self-inflicted, created by the controls we’ve buried them under….

-

2023 Reads

Image by 12019 from Pixabay I read a fair amount these days. I do it strictly for pleasure which frees me to take my time and explore a wide range of topics. While not everything I read is about investing, I find many to have relatable themes. Below is a catalog of books and papers…

-

Today’s Yield Curve Steepening Is Not Different This Time, It’s Not The Same

Image by Thomas Malyska from Pixabay Investment volatility remained elevated this year. One can point to any number of culprits. My preferred cause has been interest rate volatility. I’ve been cautious as the Federal Reserve (Fed) raised its benchmark rate. However, a popular risk indicator has recently been sending a mixed message. The yield curve…

-

Treat Alternatives Like Cuisines, Not Distinct Assets

Image by stokpic from Pixabay Investments in alternative assets (alternatives) have grown tremendously over the past decade. Drawn to their professed portfolio benefits, investors have reallocated capital from more traditional assets, like public equities and bonds, into various alternative investments. Some can hardly get enough. Yet, for all the affection, there’s nothing truly alternative about…

-

More Projects, Less Frequent Posting (For Now)

Image by Manfred Antranias Zimmer from Pixabay Dear Integrating Investor, Writing The Integrating Investor is a true joy. It’s forced me to question and defend every underlying investment belief I’ve held out in the open. I never imagined how hard that would be. Yet, your readership has supercharged my growth as an investor. I am…

-

Logically Defining Money Makes Cents

Image by F1 Digitals from Pixabay Money might be the most misunderstood topic in finance. Everyone knows exactly what it is, yet definitions greatly vary. Most reduce money’s meaning to some combination of the four functions famously stated by William Stanley Jevons in his 1875 essay Money and the Mechanism of Exchange: a medium of…

-

The Similarities & Differences Between Today & The GFC

Image by Andrew Martin from Pixabay I’ve said it before, 2023 has been a heck of a year. In just five months, four large regional banks and one major global financial institution shuttered, marking the second-worst year for bank failures. Only the Great Financial Crisis of 2007 to 2009 (GFC) was worse. Understandably, many have…

-

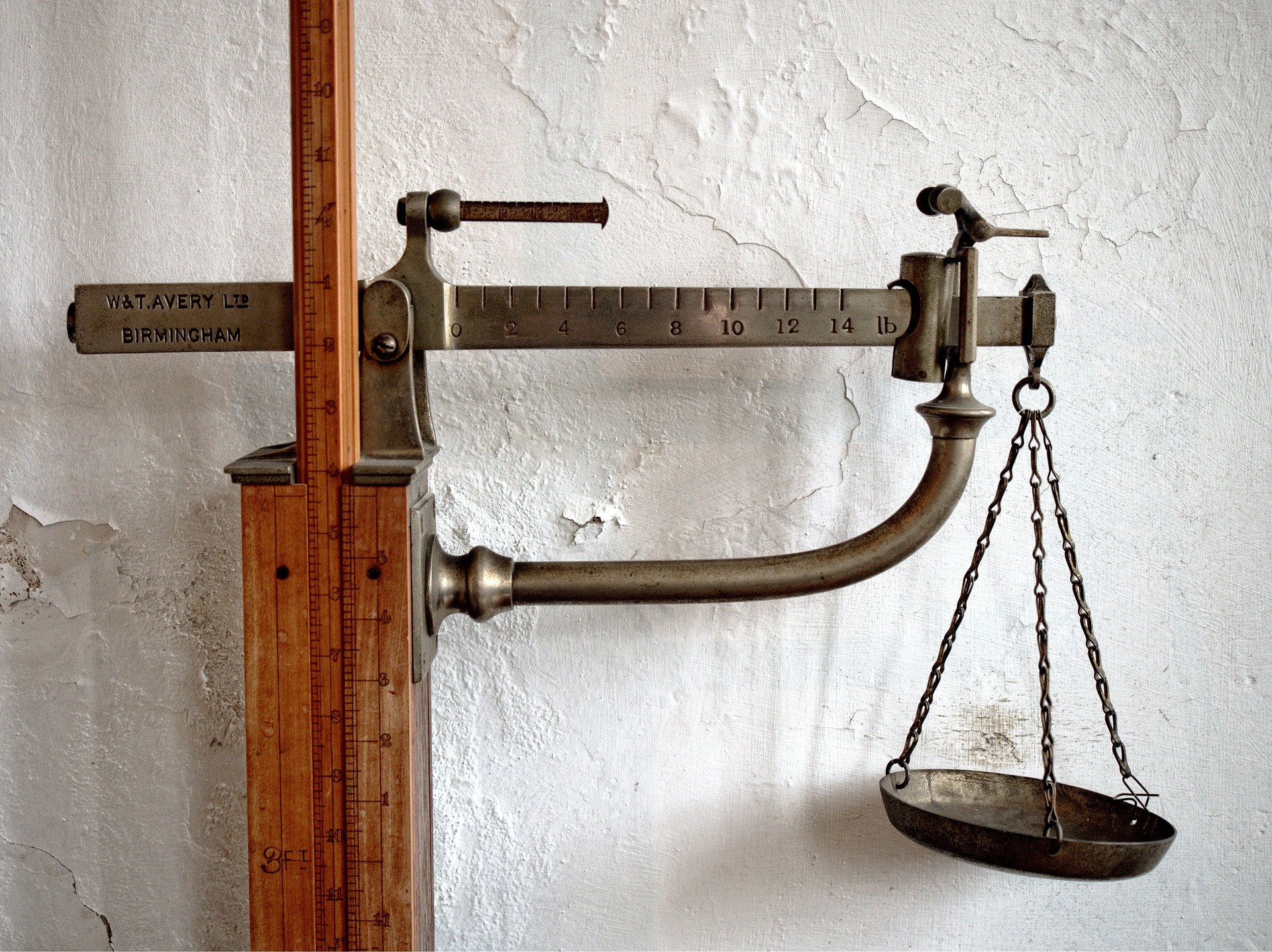

Hunting For Unknown Liabilities, Not Asset Risks

Image by Vitor Dutra Kaosnoff from Pixabay The recent wave of bank failures returned asset liability management (ALM) to the spotlight. Many correctly identified ALM breakdowns as causing their ultimate demises. Yet, ALM remains an underappreciated investment topic. It determines the fate of every company, not just the financially-oriented. Yet, few seem to fully appreciate…