Image by Arek Socha sourced from pixabay It’s no secret that emerging markets (EM) are in a bit of a rough patch. While the unfortunate events in Turkey garnered most of the attention initially, nearly anything related to EM has slid in value. What exactly is going on here? Is this just another acute crisis..

The School of Athens by Raffaello Sanzio da Urbino sourced from Wikipedia Despite the opulent or debauched images one might have about the investment industry (depending on one’s perspective), the fact is that investing is a highly intellectual pursuit. I don’t mean this in the colloquial sense where one ruminates on meaningless abstract ideas purely for..

If you’ve consumed any financial media lately, you’re likely well aware that the yield curve has been flattening. Since roughly 2014, the yield differential between the 10 year U.S. Treasury bond and any number of short-maturity ones has been compressing (the 2 year is most commonly used). Why this has much of the investment community..

Perhaps no other style of investing possesses the same degree of lore, scholarship, and celebrity as value investing. While names such as David Einhorn, Seth Klarman, and Joel Greenblatt may be household ones among diehards, Warren Buffett certainly has broad recognition even outside of the investment community. Value investing even has its very own, bona..

Image source: pixabay For this post, I’d like to offer a few “Disintegrated Thoughts” on some things I’ve been thinking about in the investment markets. These include: The ECB and volatility deleveraging Business building and ignoring valuations Sticking up for “speculation” Notes from the judo mat A spontaneously “live” ECB meeting and volatility deleveraging..

Source: Wikipedia. Engraving depicting the Amsterdam Stock Exchange, built by Hendrik de Keyser c. 1612 by Claes Jansz. Visscher Central bankers catch a lot of flak these days. To be sure, much of it is deserved in my opinion. However, there are two dominant trends in the market place – increasing allocations towards passive..

S&P 500 Index chart by TradingView As faithful Integrating Investors may know, my purpose for creating this blog is to further develop and refine my investment process. Recently, I’ve been giving some thought to incorporating technical analysis into my framework. Being open-minded, I should technically be willing to consider any technique that could provide..

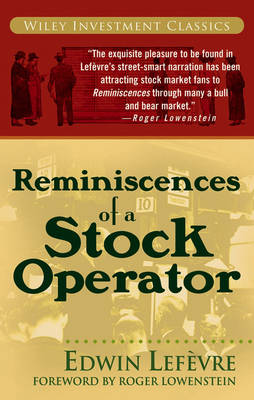

Source: Wikipedia I recently finished reading Edwin Lefèvre’s classic Reminiscences of a Stock Operator, marking my second time through the book. I first picked it up nine years ago on the recommendation of a former coworker who was a flow trader. A burgeoning credit analyst at a bulge bracket investment bank at the time, I..

Image by Peter Selbach sourced from pixabay The following is Part 2 in a two part series. Part 1 of this series discussed my view of what volatility is and how it impacts investing. Here in Part 2, I present my read of the current volatility landscape and examine what it might mean for..

Image by Kira Hoffmann on pixabay The following is Part 1 in a two part series. If there were a Word of the Year award in finance it most certainly would go to volatility. It seems like nearly every article you read makes some reference to it. Is volatility gone for good or is..